Ahmed,

Below is the proposed solution for your reference.

Richardson Motors (Make or Buy)

The "Make or Buy" problem concerns analysis of relevant costs. Hence, irrelevant costs, like fixed overhead, should be ignored.

"Make" option

To produce one unit of T305, Richardson's relevant costs are as follows:

Materials cost ...................................................... $ 2,000

Handling costs (20%) ......................................... 400

Direct labor ......................................................... 16,000

Variable MOH (1/3 X $24,000) ....................... 8,000

Total relevant product cost/unit ................... $ 26,400

Add: Opportunity cost/unit of T305 ............ 10,400 ($104,000 / 10 produced per month)

Total relevant cost (Make option) ........ $ 36,800

"Buy" option

To purchase one unit of T305 from a supplier, the relevant costs are:

Purchase price per unit ................................... $ 30,000

Handling charge (20% of materials cost) .. 6,000 (20% X $30,000)

Total relevant cost (Buy option) ......... $ 36,000

The opportunity cost of choosing to produce instead of buying from outside is:

Make option ................................................................ $36,800

Buy option ................................................................. 36,000

Incremental/Opportunity cost per unit of T305 $ 800

Number of units produced in a month ............... X) 10 units

Opportunity Cost if "Make" option is chosen ... $ 8,000

I hope this helps.

-------------------------------------------

Angel Secerio CMA, CPA

Director/Manager

Insights Financial Review Services Inc

Makati City

Philippines

-------------------------------------------

Original Message:

Sent: 06-20-2013 03:25 PM

From: Ahmed Abd El Aziz

Subject: opportunity cost

dear angle

kindly find Data below

-------------------------------------------

Ahmed Abd El Aziz

Director/Manager

Ishraqaat Al-Taqwwa Group

Kuwait

Kuwait

-------------------------------------------

Original Message:

Sent: 06-20-2013 03:14 PM

From: Angel Secerio

Subject: opportunity cost

Ahmed,

The cost data seems to have been missed here. Can you please repost and provide the complete data?

-------------------------------------------

Angel Secerio CMA, CPA

Director/Manager

Insights Financial Review Services Inc

Makati City

Philippines

-------------------------------------------

Original Message:

Sent: 06-20-2013 12:41 PM

From: Ahmed Abd El Aziz

Subject: opportunity cost

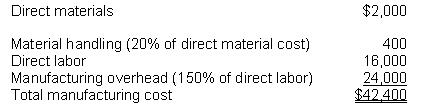

Richardson Motors uses ten units of Part Number T305 each month in the production of large diesel engines. The cost to manufacture one unit of T305 is presented below.

Material handling, which is not included in manufacturing overhead, represents the direct variable costs of the Receiving Department that are applied to direct materials and purchased components on the basis of their cost. Richardson's annual manufacturing overhead budget is one-third variable and two-thirds fixed. Simpson Castings, one of Richardson's reliable vendors, has offered to supply T305 at a unit price of $30,000.

Assume the rental opportunity does not exist and Richardson Motors could use the idle capacity to manufacture another product that would contribute $104,000 per month. If Richardson chooses to manufacture the ten T305 units in order to maintain quality control, Richardson's opportunity cost is

the answer is 8,000$ ???

-------------------------------------------

Ahmed Abd El Aziz

Director/Manager

Ishraqaat Al-Taqwwa Group

Kuwait

Kuwait

-------------------------------------------